In the recent months, the Government of India’s macro-economic policy has acquired a great deal of importance in the context of various suggestions for reversing the current slowdown in the growth of the Indian economy. The policy being presently followed by the Government of India is intended primarily to incentivize potential investors, both domestic and foreign, by facilitating Ease-of-Doing-Business and making large scale concessions to the corporate sector. In this context, the Government of India is taking credit for the relatively higher, though by no means spectacular, flow of foreign direct investment and India moving several steps up in the ladder of Ease-of-Doing-Business. The tax concessions given to the corporate sector in the last budget are estimated to amount to more than Rs. 1.40 lakh crores. Besides, various limitations on foreign investments have been removed. Industries reserved for development in the public sector are being fast opened up for private, including foreign investment. Restrictions on the proportion of private holding and control over the running of industries are being removed. Conditions laid down to serve social objectives and promote indigenization are also being progressively jettisoned. Still, there is no evidence of any significant increase in investment by private sector. This is obviously because, in the absence of demand, corporate firms are unwilling to make investment in spite of all the incentives being provided to them. Economists who are in favour of the policy of incentivizing the private sector would like the Government to go further and implement other items on their reform agenda, such as labour market liberalization, removing constraints on acquisition of land for industrial purposes etc. In their advocacy, they brush aside the negative impact such reform measures are likely to have on the incomes, living conditions and the economic security of the workers and the agricultural class. They also refuse to concede that the policy of hiring and firing of labour will be counterproductive as it would squeeze the demand further in a situation of huge demand deficit.

Some economists are making a plea for accelerating investments in the building of infrastructure for generating additional income and for creating conditions for stimulating investment in general. No sensible person will oppose additional efforts to build infrastructure which continue to remain awfully deficient. But while talking about infrastructure, these economists mean only physical infrastructure in the domain of transport, energy etc. They hold no brief for investment in human infrastructure and for enabling the common citizens, particularly the marginalized groups among them, to meet their basic needs guaranteed under the Indian Constitution. They also ignore that investment in physical infrastructure is not as labour-intensive as that in several other sectors, and that large scale projects in this field have long gestation periods.

Prof. Abhijit Banerjee, the latest winner of the Nobel Prize in Economics, during his recent visit to India, has been one of the few economists of repute who have laid emphasis on making incomes available to the poor who are likely to spend them for buying goods and services, the enhanced production of which offers the best chance for the Indian economy to get back on the high trajectory of growth. In this connection, he singled out Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA) and direct income transfer to the poor. But he also did not mention the potentiality of investment in the social sectors like education and health for creating demand by way of opening avenues for large scale employment in order to stimulate growth in the short run and impart sustainability to it in the medium and long terms.

Dr. Manmohan Singh’s article published in The Hindu on 18 November, 2019 has attracted a great deal of attention. According to him, the main factor responsible for the current sorry state of the Indian economy is the lack of confidence among those who can invest. In listing out those among whom confidence needs to be created, he refers specifically to investors, entrepreneurs and the business class. This is one point on which the present Government cannot be faulted. It has sought to take the programme of the UPA Government to incentivize the corporate sector to the logical conclusion with maximum speed. In this, there is hardly any difference between the macro-economic policies of the present Government and those adopted by the UPA Government. It was therefore not surprising when Prof. Abhijit Banerjee characterized the development strategy followed by the present Government during the period 2014-18 as UPA-III.

It is widely recognized that the social sectors in India are grossly under-funded. No mainstream economist or policy maker has come out with a suggestion for enhancing expenditures in these sectors to a level close to what is really required. On the contrary, they have taken the view that public expenditure in these sectors depends upon the resumption of the path of high growth rate, which will make additional revenues available to the Government, thus enabling it to incur additional expenditure in the social sectors. Thus, these economists and policy makers have made expenditure in social sectors conditional upon attaining and maintaining high rate of growth of the economy.

There is very little justification for establishing such a relationship. Expenditures in social sectors are designed to ensure the exercise of fundamental rights available to the citizens under the Indian Constitution. Among expenditures for the realization of the fundamental rights, investment in social sectors alone cannot be singled out for being made conditional upon an increase in the rate of growth, while several other sectors, such as policing and other arrangements for the security of the people, which have a bearing on fundamental rights, have first or priority claims on the budgetary resources of the Government.

Most mainstream economists and policy makers also believe that expenditure in social sectors can only have a long term impact, and what is needed now is macro-economic policies which can have the immediate effect of reviving demand. This belief is flawed, if not erroneous. It can be demonstrated that increased expenditures in social sectors in the magnitudes required for meeting the objectives therein, can have a short and medium term effect of enhancing employment, generating demand and attracting investment.

Investments in social sectors can create large scale employment in the short run. For example, in elementary schools alone, there are vacancies of more than 10 lakh teachers. This is in spite of the legal obligation of the Government under the RTE Act to fill in all such vacancies by trained teachers by the year 2015. In fact, in order to universalize elementary education, which is the principal objective of the RTE Act, many more teachers are required to be recruited and trained than the number of existing vacancies. Moreover, there is an indication in the New Education Policy of the Government that three years of pre-primary schooling and two years of higher secondary schooling will be brought under the RTE Act. If these levels of school education become a part of the RTE Act, there will arise a need of appointing and training lakhs of teachers at these levels also. This may take the figure of the employment of additional teachers to 30 lakhs or so. Employment on this scale will have the immediate effect of creating huge demand in the economy. Moreover, even the provision in the RTE Act for building school infrastructure has only been partially implemented; only 12.7 per cent of the schools at the elementary stage are compliant with the RTE norms for physical infrastructure. If these norms are fully implemented at the level of elementary education and extended in a suitably modified form, to secondary and pre-primary education, it will generate huge additional demand.

Similarly, in the health field, there is vast number of vacant posts for professionals at different levels. There is a huge deficit of para-medical workers, middle level health workers, nurses and trained doctors. This is evident from the long queues of patients to avail themselves of the services provided in the presently inadequate number of primary health centers and Government hospitals.

The fact that health and education are of instrumental value in driving growth, creating employment and improving people’s well-being is widely recognized. Education has a crucial role to play in gaining employment and retaining employability. Available data suggest that those with good education are the main gainers from the opportunities created by globalization. If we compare 2011 and 2017-18 data, the gap in educational attainment emerges as the single most important factor separating the gainers from losers of the high rate of growth during this period.

Health and education have been widely recognized as public goods. In most of the developed and several developing countries, these services are either provided free or are heavily subsidized by the state. Unfortunately, in India, we find the opposite trend of the state withdrawing from the provision of these services and consequently their rapid privatization. In fact, the Government has a well-entrenched policy of encouraging privatization in both health and education. Privatisation in both these sectors has not led to efficiency or improvement of quality. It has destroyed public sector institutions in these sectors, promoted greater inequality and pushed the poor out.

One of the widely publicized schemes of the present Government for creating employment is skill missions in order to bridge the skill deficit. However, in the absence of good general education, these missions have not produced the desired results in spite of channeling of large amounts of resources into the skill development programmes.

The gestation period of investment in the education and health sectors is not as long as it is made out to be. This is particularly so in the health sector where massive investments for reviving public institutions which have decayed or been dismantled and for training medical, para medical and health management personnel, can bring immediate benefits to the suffering masses, stabilize their incomes and enhance their contribution to the overall development of the country. In the education sector, a gestation period of only five years was envisaged in RTE Act for universalizing quality education at the elementary stage. If the legally mandated schedule of five years for the implementation of the RTE Act would have been adhered to, India would have by now a millions-strong army of well-educated young persons – the most potent instrument for accelerating and sustaining growth. Withdrawal of the state from provisioning of the public goods of health and education services has been the most important factor accounting for the dissipation of the dynamism of the Indian economy.

Massive investment in the social sectors, particularly health and education need not be at the cost of other schemes which are employment intensive and which have the potentiality of creating demand on a large scale in the short and medium run. MNREGA figures most prominently among these schemes. It is believed that the employment created and hence income generated under MNREGA played the most important role in mitigating the adverse impact of the global economic and financial crisis of the years 2008 and 2009. The income generated by MNREGA is spent mainly by the lower income strata of the rural sector, but indirect income is generated through the multiplier effect not only by the spending of the people belonging to the lower income strata, but also by the middle and higher income groups in both rural and urban areas. The poor people who have high propensity to consume generate demand for consumption of goods and services the production of which is carried out mainly by people belonging to the middle and top income groups. Therefore, the coverage of rural MNREGA should be expanded and it should be extended to urban areas too. But, as it happens, even the present incarnation of MNREGA, is choked by financial squeeze by the Government. The demand for work under the scheme is increasing every year. There is, therefore, scope for investing about Rs. 1.30 lakh crores in rural MNREGA even in its present form. Moreover, there is a payment liability to the workers every year by about 20 per cent. So, when the allocation comes for the next budgetary year, the first claim on it is the 20 per cent of carry-over liability. Thus, the arrear continues year after year.

A recent disturbing trend has been that young persons between the age group of 18-30 years are coming to work under MNREGA. This shows the distress level in the employment market. This distress can be mitigated by innovatively designing MNREGA so that educated persons can work in this programme. For this, the essential first step is to extend the scheme to the urban areas. MNREGA wage rate is lower than both agricultural wage and open market wage rates. In some States, the gap is quite significant. If these rates are increased, larger number of the unemployed in the rural areas would join this scheme.

Besides, the Government should speedily go about creating employment by filling in vacancies amounting to nearly 200 million, in the Central and State Governments. If these vacancies are filled on a priority basis, they will immediately generate demand in the economy on a significant scale.

The other important mechanism to create large scale demand in the short and medium run is direct income transfers to the poor. The two schemes announced for this purpose on the eve of the last general elections were Nyaya by the Congress Party and PM Kisan by the BJP. As the Congress did not come to power, the Nyaya scheme has remained only on paper. On the other hand, resources made available to the poor under the PM Kisan are grossly inadequate and hence fall short of imparting any significant stimulus to the growth of the economy. The other schemes which provide vast scope for creating demand relate to social security and food security. There are legislations obliging the Government to provide security to citizens in both these critical areas. But these Acts are yet to be implemented properly.

A question frequently raised is: how to find resources for massive investments in sectors and schemes which can create demand on a large scale. The answer to this question is not difficult to find. One can pose the counter question as to how resources were found for providing incentive to the corporate sector amounting to over Rs. 2 lakh crores per annum over the last few years, and for the cuts in the corporate taxation which resulted in a foregone revenue of Rs. 1.40 lakh crores. One may also ask as to how the Government would be able to mobilise resources for its publicly announced plan of investing Rs. 100 lakh crores in the next five years for building physical infrastructure. Thus, the issue essentially is not of paucity of resources but the priority set by the Government for utilizing resources at its disposal. And obviously, the priority to make additional incomes available to the corporate sector which, in the absence of demand, is unlikely to be invested.

At the same time, it is also true that for the last 30 years or so, the Government has not made any effort to mobilise domestic resources on the scale needed for stimulating and sustaining growth. The tax ratio in India at the level of 11.7 per cent is one of the lowest in the world. Moreover, some 93 per cent of the corporate sector companies do not pay any tax or pay very little tax. The centerpiece of Government’s drive towards modernization during this period has been predicated on inflows of foreign capital. The whole argument of successive Governments seems to have been that foreign investment will come, close the infrastructure gap and develop the manufacturing sector, as though foreign investment is driven by altruistic motives. But foreign investment in India has always played a marginal role in closing the resources gap, though it might have served important strategic purposes.

It needs to be clarified that the origin of the macro-economic policies followed by the present Government goes several years back when the other Governments were in power. The origin can be traced to the early 1990s when full-fledged liberalization was introduced, public sectors came to be dismantled piece by piece, and sector by sector, and the process of withdrawal of the Government from the provisioning of public services started. This was not warranted by the dictats of the neo-liberal development strategy. Almost all developed and many developing countries which have resorted to neo-liberalism, have invested adequately for supplying the public goods of health and education. As Amartya Sen and several other economists have brought out by the help of empirical data, investments in these social sectors have turned out to be the main factor accounting for the success of the neo-liberal policy in these countries. India has unfortunately been an exception to this historical trend. This has been at the cost of the efficiency and competitiveness of the Indian economy and has resulted in the denial of basic human rights to the teeming millions in the country.

We are familiar with the phenomenon of jobless growth associated with the march of the current phase of globalization. In India too, between 2004-05 and 2013-14, the country attained higher rates of economic growth with little job creation. Between 2014-15 and 2017-18, a relatively lower rate of growth was accompanied with very low or negative employment growth. Elasticity of employment which was 0.57 in the mid-1970s and 0.45 in the 1980s and the early 1990s, dropped to 0.09 between 2009 and 2015. The rate of employment has shot up to 6 per cent recently which used to be less than 3 per cent a few years ago. The labour force participation rate fell sharply from 43 per cent in 2004-05 to 36.9 per cent in 2017-18. In the unorganized sector, this decline was really precipitous.

Over the recent years, the gross value added (GVA) has increased in manufacturing and services sectors but it has so happened only with the non-wage part of the GVA while wage part in the GVA has been squeezed. Both the urban and rural wages have gone down in recent years leading to a decline in total demand and consumption in the economy. This is also one of the major factors behind the current demand crisis.

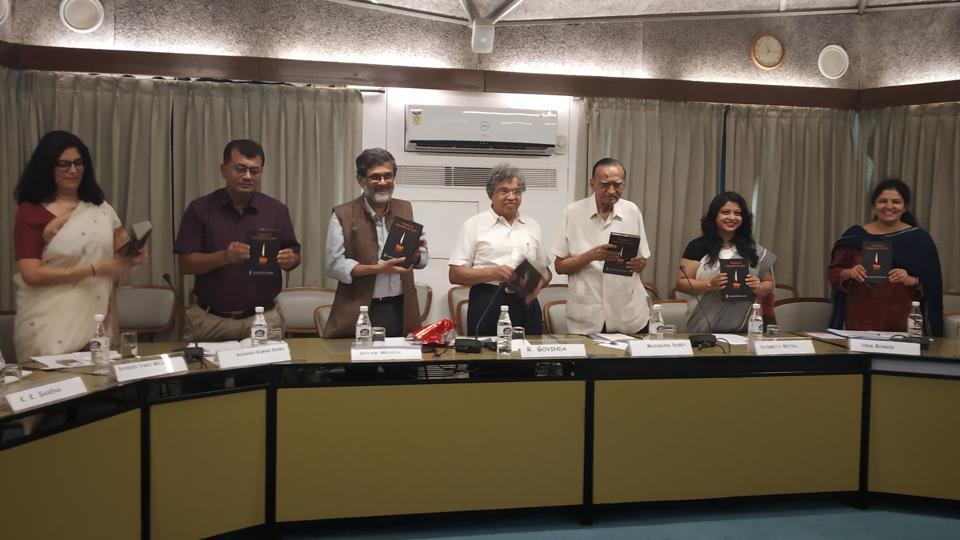

The Council launched the book Visions of Education in India edited by Prof. Muchkund Dubey and Dr. Susmita Mitra at the India International Centre (IIC) on 2nd September 2019. Prof. Shyam Menon, University of Delhi and former Vice Chancellor of Ambedkar University, Delhi was the Chief Guest of the event. Other panelists were Prof. Avinash Kumar Singh, Head, Department of Education Policy, National University of Educational Planning and Administration (NUEPA), Ms. ShireenVakil Miller, Head of Policy & Advocacy at Tata Trusts, and Dr. Hem Borker, Assistant Professor, Centre for Study of Social Exclusion and Inclusive Policy, Jamia Millia Islamia. The panel discussion was chaired by Professor R Govinda, Distinguished Professor of CSD and former Vice Chancellor of NUEPA.

The Council launched the book Visions of Education in India edited by Prof. Muchkund Dubey and Dr. Susmita Mitra at the India International Centre (IIC) on 2nd September 2019. Prof. Shyam Menon, University of Delhi and former Vice Chancellor of Ambedkar University, Delhi was the Chief Guest of the event. Other panelists were Prof. Avinash Kumar Singh, Head, Department of Education Policy, National University of Educational Planning and Administration (NUEPA), Ms. ShireenVakil Miller, Head of Policy & Advocacy at Tata Trusts, and Dr. Hem Borker, Assistant Professor, Centre for Study of Social Exclusion and Inclusive Policy, Jamia Millia Islamia. The panel discussion was chaired by Professor R Govinda, Distinguished Professor of CSD and former Vice Chancellor of NUEPA. Published by Aakar Books, Visions of Education in India seeks to review education in the country through a matrix of nation-building, democratization process, identity, power, social and economic divisions, and social hierarchies – all in the overall framework of globalization and neo-liberalism. The book has contributions from 15 domain experts, leading academics and activists (including the editors themselves), Medha Patkar, J.B.G. Tilak, Prabhat Patnaik, G. Hargopal among others. The book traces the journey of visions of education since the ancient times, and emphasizes that in the complex pluralistic society like that of India, it is nearly impossible to choose a single vision of education that satisfies all our needs and aspirations. What is important is to be able to reconcile the differences among the visions to the extent possible and bring the best elements of these visions within a unified policy framework.

Published by Aakar Books, Visions of Education in India seeks to review education in the country through a matrix of nation-building, democratization process, identity, power, social and economic divisions, and social hierarchies – all in the overall framework of globalization and neo-liberalism. The book has contributions from 15 domain experts, leading academics and activists (including the editors themselves), Medha Patkar, J.B.G. Tilak, Prabhat Patnaik, G. Hargopal among others. The book traces the journey of visions of education since the ancient times, and emphasizes that in the complex pluralistic society like that of India, it is nearly impossible to choose a single vision of education that satisfies all our needs and aspirations. What is important is to be able to reconcile the differences among the visions to the extent possible and bring the best elements of these visions within a unified policy framework.